The Optimize Portugal Golden Opportunities Fund (OPGOF) is an open ended fund investing in Portuguese equities and bonds. Offers daily liquidity, full transparency, and strong management oversight.

The fund aims to provide participants with long-term investment appreciation, by investing in a portfolio that has between 80% to 100% exposure to Portuguese domiciliated companies. The fund does not have any exposure to real estate.

Suitable

- Any investor that is looking for exposure to the Portuguese equity and bond markets, though an open-ended fund with daily NAV and liquidity, diversified and with no redemption restrictions.

- Any foreign citizen seeking the Golden Visa as the fund complies with the eligibility criteria.

Exposure

The fund will have at least 60% of its portfolio invested in stocks and only invests in listed assets, stocks, bonds, or mutual funds. Its diversification strategy aims to reduce the volatility over the long run.

- Minimum Fund Investment: € 1000,00

- Minimum Investment for Golden Visa Eligibility: € 500 000,00

- Risk level – 5 (Moderate)

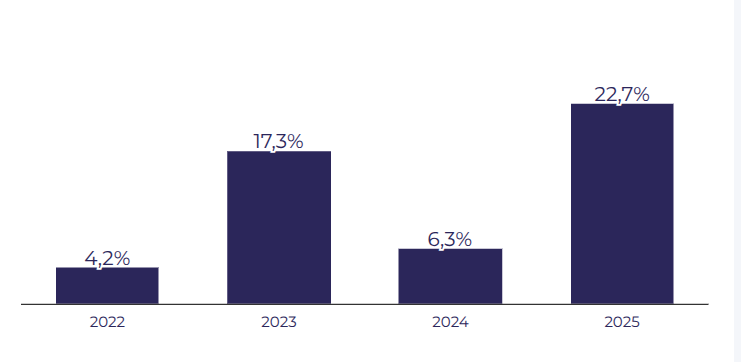

- Returns – 22.7% for 2025

U.S. Investors

- Subscribe using your IRA – no LLC required

- Only Portuguese investment fund eligible for the Golden Visa and registered with the U.S. SEC.

Sector breakdown

- Financials – 24,9%

- Industrial 19,5%

- Consumer Staples 13,3%

- Materials 11,5%

- Others 30,8%

Golden Visa Eligible Fund

The fund is eligible in the new golden visa regulatory landscape since it does not invest in real estate directly or indirectly. Portugal Golden Opportunities Fund is an open-ended UCITS multi-asset fund, that aims to provide participants with longterm investment appreciation through a balanced investment in different classes of listed assets with a predominant focus on Portugal. It invests at least 60% of its assets in shares of companies headquartered in Portugal and at least 80% of its assets in shares and debt securities of companies headquartered in Portugal listed on Euronext Lisbon or public debt securities issued by the Portuguese Republic or other public entities.

Investment thresholds: the fund will invest between 60% and 100% of the Net Asset Value (NAV) in equities or equivalent, between 0% and 10% in investment funds and between 0% and 40% in sovereign or corporate debt.

The fund reached €176M in AuM as of July 31st, 2025.

US Citizens

The fund works with leading SDIRA custodians that allow investments in our Golden Visa-eligible fund. If your current provider doesn’t allow it, you can easily transfer your IRA to a provider that does—we can guide you through the process.

Brochure

Download fund presentation and brochure