Capital Green III is an active closed-end credit fund focused on supporting small and medium-sized enterprises (SMEs) in Portugal. With a target subscription capital of €25 million, the fund aims to provide tailored financing solutions that foster growth and innovation within the SME segment. The fund is a successor to Capital Green I and Capital Green 2 deployed successfully.

The Fund’s lending activity shall be backed by a good collateral package and shall be senior to equity. The Fund’s lending policy targets loans with maturity ranging from two to four years to creditworthy companies.

Capital Green III focuses on:

- Projects promoting energy efficiency and using sustainable practices.

- Projects that have positive impact on local communities at different levels.

- Projects that do not show ethical conflicts.

Fund Details

- Fund Name :Capital Green

- Type: Closed-end Credit Fund

- Fund Manager: Finprop Capital, SGOIC, S.A.

- Custodian: Bison Bank

- Auditor: Ernest Young

- Fund Launch: January 2025

- Liquidation Period Until January 2035

- Fund Size: € 25 million

- Minimum Subscription: € 200,000

- Fees: Fully absorbed by Class C units, ensuring transparency and simplicity for other investors.

- Management Fee: 1%

- Classes of Participation Unit: A, B, C and D

- Class A, B & D Fixed

- Return

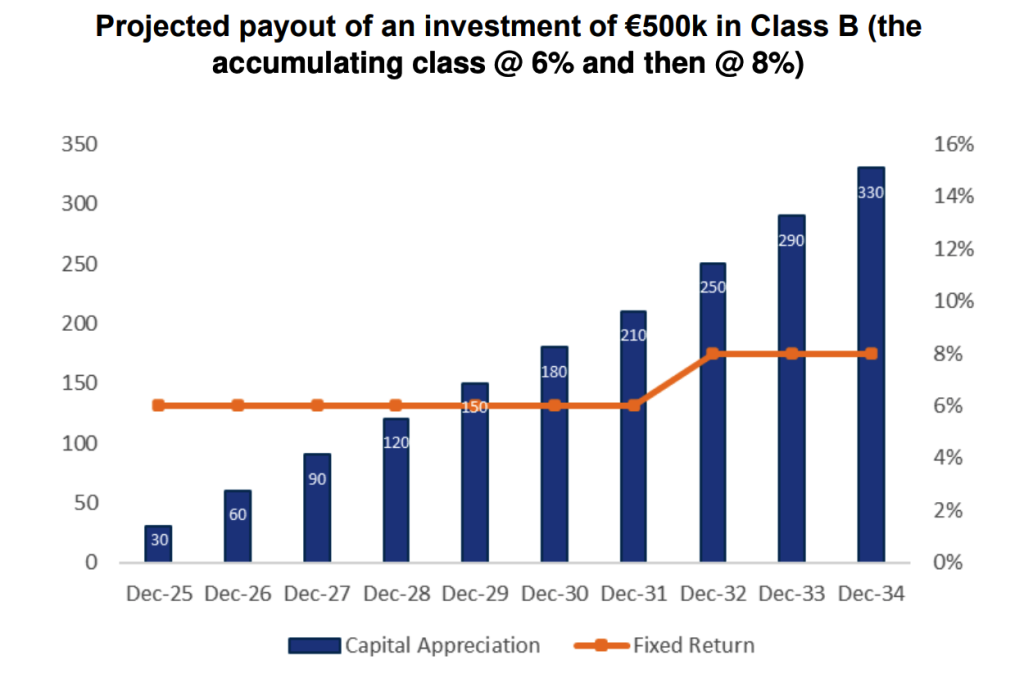

- Class A: Distributing @ 6% (8% after 2032);

- Class B: Accumulating @ 6% (8% after 2032)

- Class D: Distributing @ 8% (10% after 2032 – limited availability)

- Class C: Sponsor-only. Residual-claim class that supports the Fund’s running fees

- Download – Presentation and Teaser (pdf)

Returns

Golden Visa

Golden Visa eligibility, the minimum investment requirement is 500,000€

Exit

he Fund provide flexible and strategic exit solutions to ensure investor liquidity:

- Put Options: To ensure investor liquidity, the sponsor offers strategic exit mechanisms, including put options for capital redemption following the three years lock-up period.

- Secondary Market Transactions: The fund will remain flexible in providing liquidity to investors through secondary market transactions.

Tax Free

Under current tax regulations, the fund benefits from a full exemption from Corporate Income Tax (CIT). Non-resident investors also enjoy a 0% local tax rate, maximizing the net return on their investment.

About

FINPROP is a Fund Management Company, authorized and regulated by CMVM. CMVM is the Portuguese financial authority.